There's a component here that's not being mentioned, and it's significant.

It's passed over in the books.

But, simply, a starship loan is not a car loan or a house loan.

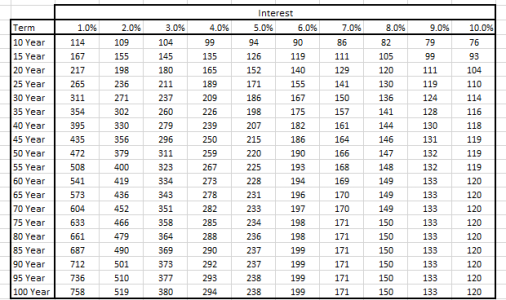

Car loans are lousy. A collateral backed loan against a depreciating asset. Make sure you get your interest up front, its ok for the buyer to be upside down in the loan, but not the bank. A house loan is against an (ideally) appreciating (if not at least keeping with inflation) asset, so a much less riskier product for the bank. That's what the 20% down is for on the house loan, to eat some potential depreciation or damages if the bank has to liquidate the asset, they're, again ideally, always in the black on the loan.

A starship loan is against the BUSINESS that the starship is part of. Not the ship itself. The bank really doesn't care about the ship, they care about the cash flow of the business. It's not really a secured loan (the asset is too dangerous in this case -- space travel, pirates, depreciation, etc.) But show a business plan that works and is profitable in that environment? Then, yea, you can get a loan from a bank to run the business (of which the ship is a capital expense for).